Sustainable Supply Chains for the Energy Transition – Background

The supply chain concentration of critical raw materials

April 17, 2025

Background

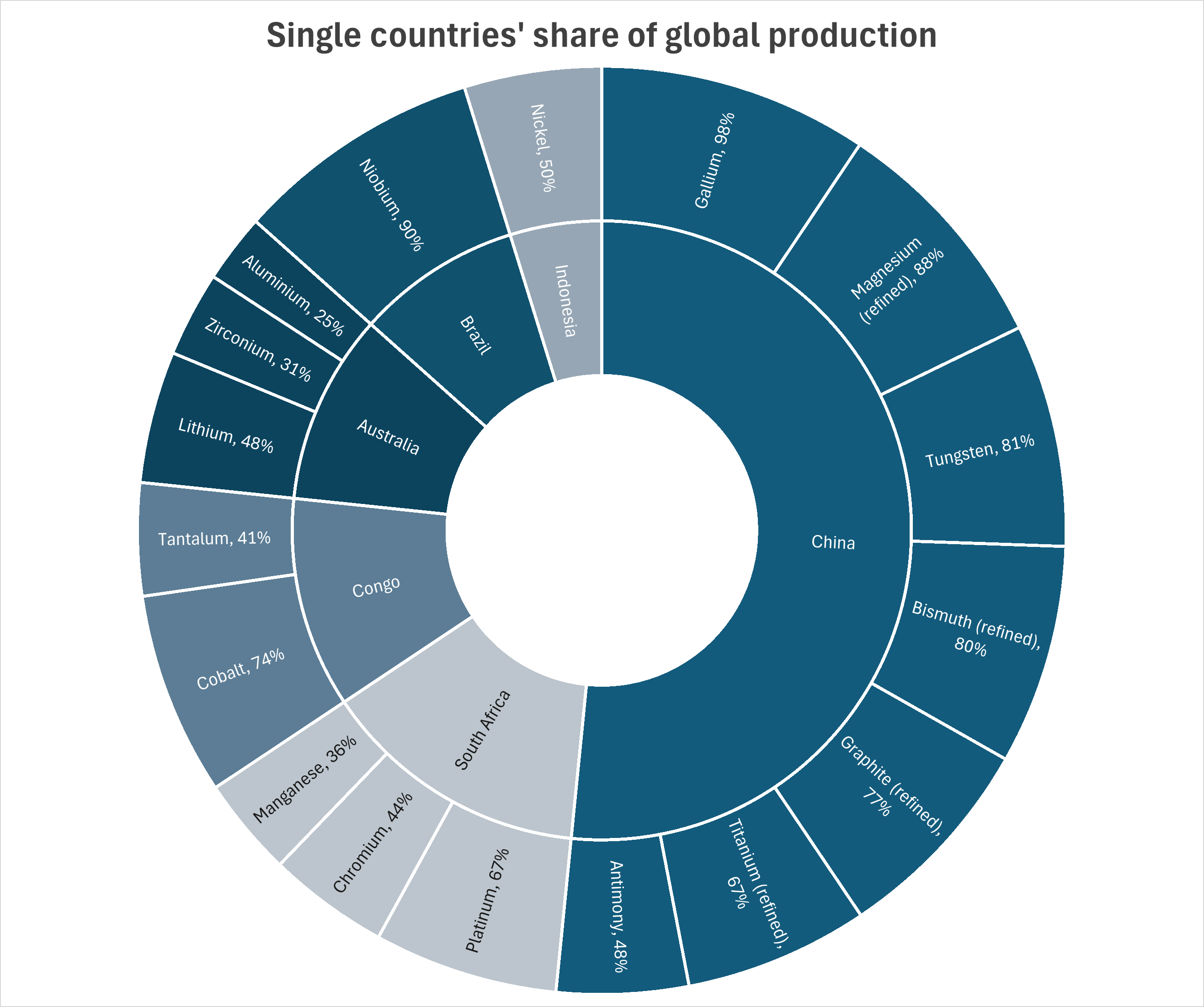

The production and mining of critical raw materials are concentrated in a few countries that possess rich geological deposits. For instance, China dominates the production of rare earth elements, accounting for a substantial portion of the global supply. Similarly, Australia and Chile are major producers of lithium, while the Democratic Republic of Congo is a leading source of cobalt. These countries have the potential to benefit from their abundant natural resources, which enable them to control a significant share of the global market – but also could face challenges with human rights, environmental degradation and social unrest due to inequality, that often accompany natural resource extraction in developing countries. An approach to trade that addresses these issues would help promote the beneficial effects while mitigating adverse effects.

For many raw materials, China is a key player with refining and processing capacities far exceeding those of other countries. Other countries have managed to carve out niches for specific materials refining, such as Indonesia with its nickel industry, by banning raw nickel exports. This concentration of refining capacity in specific regions creates dependencies for other countries that rely on imported refined materials for their industries.

The graphic below shows how single countries dominate certain raw materials’ production as a share of the total global production.

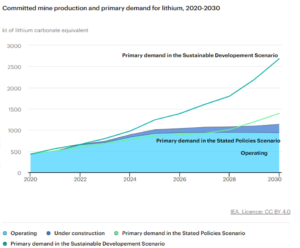

This concentration in raw material extraction and refining is met with a substantial expected increase in demand. In an International Energy Agency net zero emission scenario, by 2050 demand for copper will rise by 150%, nickel by 210%, cobalt by 300%, graphite by 490%, lithium by 1000% and manganese by 1200%. In this regard it is important to consider the long lead times in the mining sector from initial exploration to production and the role of uncertainty. This is highlighted in the demand forecast for lithium. In a stated policy scenario, the gap between supply and demand is significantly smaller than in a sustainable development scenario. The energy transition, an essential pillar in the transition to net zero, therefore critically hinges on our ability to develop new sources for critical raw materials at an accelerated pace and supported by a policy scenario that allows for a degree of planning certainty.

A Mining Monitor to Track Supply Chains

In order to go beyond trade statistics and track ESG dimensions along the CRM supply chain, we are developing a novel approach to track materials:

- From mining operation

- to processing facility

- by type of material

- by responsible company (exporter & mine operators)

- to the point of exit from the country (usually port)

- via the shipping vessel

- to the port of entry in the destination country

In this data sample we can see that copper from the Anglo American Sur mine is mostly exported unprocessed (HS2603) by Anglo American Sur SA via Ventanas port using three vessels (Dalian Star, Maine Dream and Nordic Seoul) to Shanghai (China) and Salvador (Brazil). Connecting this information with, for example, environmental footprints of mines, carbon footprints of refineries and vessels, extreme weather events at port locations allows us to assess sustainability-related supply chain risks.