Mainstreaming Conversion- and Deforestation-Free Finance for a Sustainable Future

Aligning incentives across the value chain

September 17, 2025

We aim to make conversion-free finance a mainstream part of markets and regulations in Europe and globally, while strengthening the role of local stakeholders for a sustainable transition.

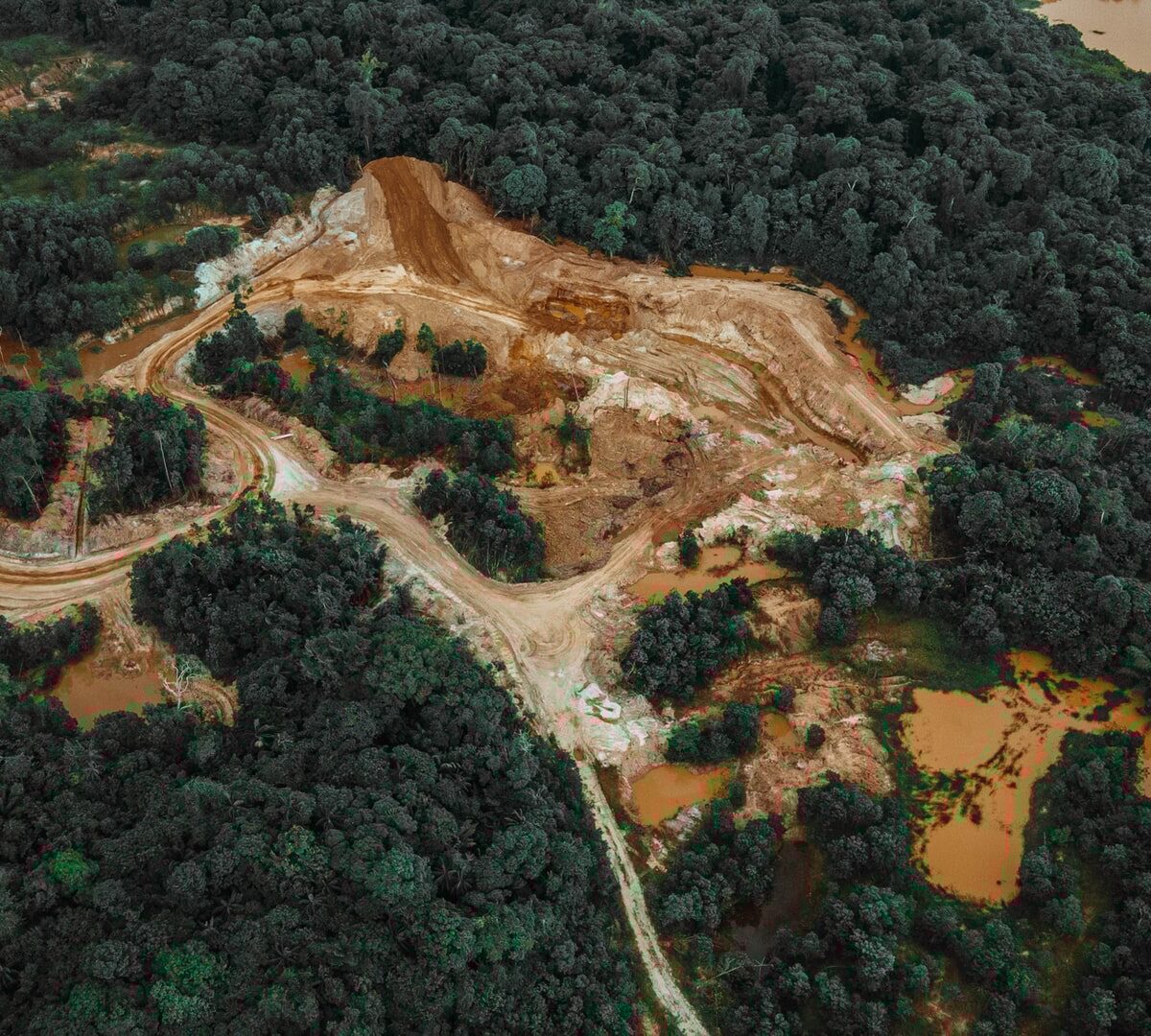

Maintaining our world’s forests is critical to achieving climate and biodiversity goals, yet money continues flowing to deforestation rather than sustainable business practices aligned with the needs and interests of Indigenous Peoples and Local Communities (IPLCs) as well as smallholders.

Forest 500 reports that, as of October 2022, 150 financial institutions had provided USD 6.1 trillion to the 350 companies most responsible for tropical deforestation. Around 80% of financial institutions still have no policies or commitments on deforestation.

On the one end of value chains, local stakeholders have the power to facilitate the transition to deforestation-free production through local knowledge and action. But they need to substantially benefit from it.

On the other end of the value chain, financial institutions (incl. banks and investors) are not only part of the problem but hold the key to positively shape global markets. Deforestation represents both a climate & biodiversity as well as a financial risk to which financial institutions are exposed through investments and lending portfolios. But they lack clear incentives and often face data challenges.

Incentives are misaligned.

Regulations such as – in Europe – the EU Deforestation Regulation (EUDR), the Corporate Sustainability Due Diligence Directive (CSDDD), and similar frameworks worldwide are creating new obligations for sustainable supply chains. To mainstream conversion- and deforestation-free corporate action, finance, policy, and on-the-ground realities must connect.

This is how we contribute at Climate & Company:

- Mobilise a critical mass of financial institutions, who can voice the importance of their role in financing conversion- and deforestation-free food value chains. We partner up with banks and investors active in key economies to pioneer robust deforestation risk mitigation, due diligence processes and just transition plans. Lessons from our partner financial institutions are channelled to influence peer investors worldwide to strengthen due diligence and raise market standards.

- See for example our work on Making Deforestation Due Diligence Work in Practice and our data spin-off Datura — Home

- Improve access to finance for deforestation-free production. Together with partner organisations, we empower stakeholders along the supply chain to develop new business models that connect global information and data demands with local knowledge.

- See for example our financial solutions database for smallholders, and our repository of case studies and innovations actions towards deforestation-free production.

- Mainstream via regulation for market uptake. Knowledge and experience obtained by our partner financial institutions are fed into the policy cycle to achieve regulation as ultimate incentive for full market uptake. Together we engage with policymakers to create strong and enabling regulatory frameworks, in the EU and beyond. By linking Europe’s downstream markets with upstream tropical forest countries, we aim to deliver durable, systemic change that halts deforestation.

- See for example our take the new “simplification agenda” of the EU Commission in Sustainable Views.

Our projects:

Sustainable finance instruments for sustainable land use funded by the Gordon and Betty Moore Foundation.

Solutions for Mobilising Financial Sources and Enhancing the Financial Framework for Investments on Deforestation-Free Value Chains, as part of the Sustainable Agriculture for Forest Ecosystems (SAFE) project funded by the European Commission and the German Federal Ministry for Economic Cooperation and Development (BMZ).

EU-Brazil Partnership to Accelerate the Implementation of the EU Regulation on Deforestation-Free Products, in collaboration with Amigos da Terra-Amazonia Brasileira and implemented by Sequa.